Charting New Waters: 2023's Investment Landscape

Predicting what the stock market will do is easy. It’s getting the prediction right that’s difficult. If you could tell me what corporate earnings (or net profits) will be for this year and what investors would be willing to pay for those earnings, I could tell you with great precision where the market would land by the year’s end. Unfortunately, there are so many unpredictable variables that impact corporate earnings. Even if you could get reasonably close, it’s practically impossible to know what investors’ appetite for risk will be at any given time. People’s emotions play a large role in determining the price of stocks and what valuation gets attributed to corporate earnings. So as a professional, what am I doing writing this paper and what’s the use in attempting to draw any conclusions about current market conditions and what the future may hold? Being informed hopefully gives you a little more confidence having your hard-earned money invested for the long-term. We can also put current conditions into context given historical norms and make reasonable judgments about near-term risks and long-term opportunities. After all, Mark Twain once said that “History never repeats itself, but it does often rhyme.”

First, what happened last year?

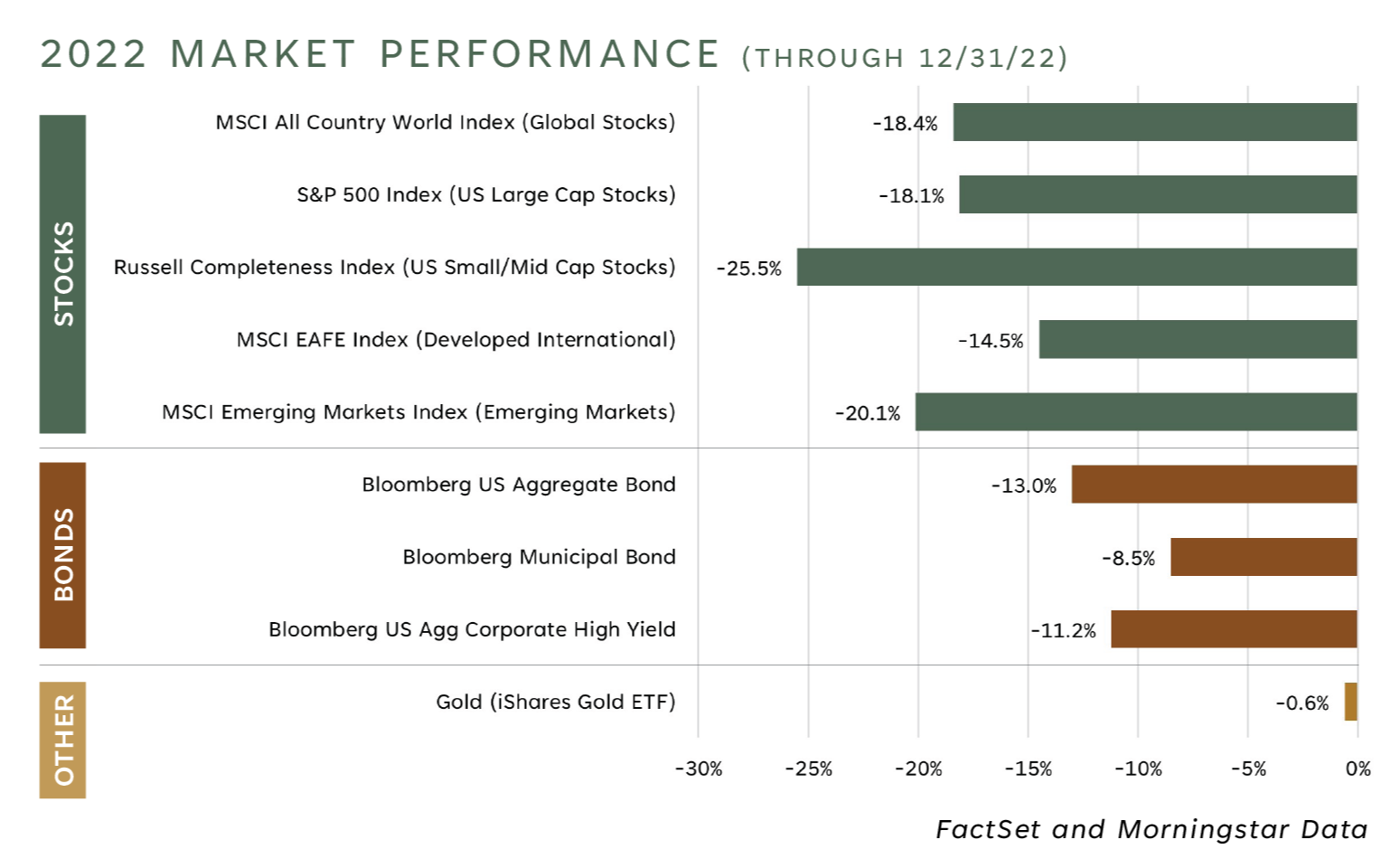

Last year, stocks and bonds both saw double digit losses as inflation surged higher, the Russian/Ukraine conflict raged on, and China struggled to open its economy due to the pandemic. Below is a quick snapshot of how various parts of the market performed.

The Federal Reserve caused a lot of uncertainty with seemingly being out of touch with the reality of inflation and having to play catch-up with interest rate increases and an ongoing balance sheet runoff — letting bonds mature and not providing support for new purchases. It was a year to invest more in defensive companies, maintain bonds with shorter maturities (they tend to hold up better when interest rates rise), and have an allocation to gold. Doing all three helped to mitigate the downside.

We must adapt to a new investment landscape.

For the last several decades, we’ve had powerful tailwinds propelling stock and bond markets to new heights. The federal funds rate, which impacts lending and money market rates, was a whopping 20% in 1980 and got down to zero during the ’08 Great Financial Crisis. Rates remained at or near zero until recently when the Federal Reserve started a campaign to fight inflation during the spring of last year. The S&P 500 Index rose from 102 in August 1982 to 4,796 at the beginning of 2022 (a compounded average return of over 10% per year). A declining interest rate environment has probably been the single biggest tailwind for stock and bond markets over the past 40 years. Globalization and technological advancements also played a role. The Federal Reserve could certainly reduce rates once they feel they’ve conquered inflation, but rates can’t come down by 20% again over the next 40 years. We must get used to a new environment where interest rates aren’t persistently dropping.

Globalization has been a boon to global commerce over the years and a benefit to keeping inflation low by enabling companies to procure lower cost materials from other countries and manufacture abroad where costs of property and labor might be lower. With Brexit, the pandemic, and increased global conflict pushing countries to feel the need to become more self-reliant, we have likely seen the peak of globalization. We are now moving in the direction of shifting back to domestic procurement and manufacturing, and tax breaks even incentivize deglobalization. This initially could lead to higher inflation until domestic manufacturing capabilities advance and economies of scale are realized.

Technology is the one major bright spot that continues to be a driving force for growth and helps to bring costs down, thus keeping a lid on inflation. The U.S. has been and continues to be a leader in technology and the possibilities are endless for advancements in mobile computing, internet of things, and health sciences among other things. Technology, for better or for worse, is dramatically changing the way we work and experience leisure. Change only seems to be accelerating.

So, what's the outlook from here?

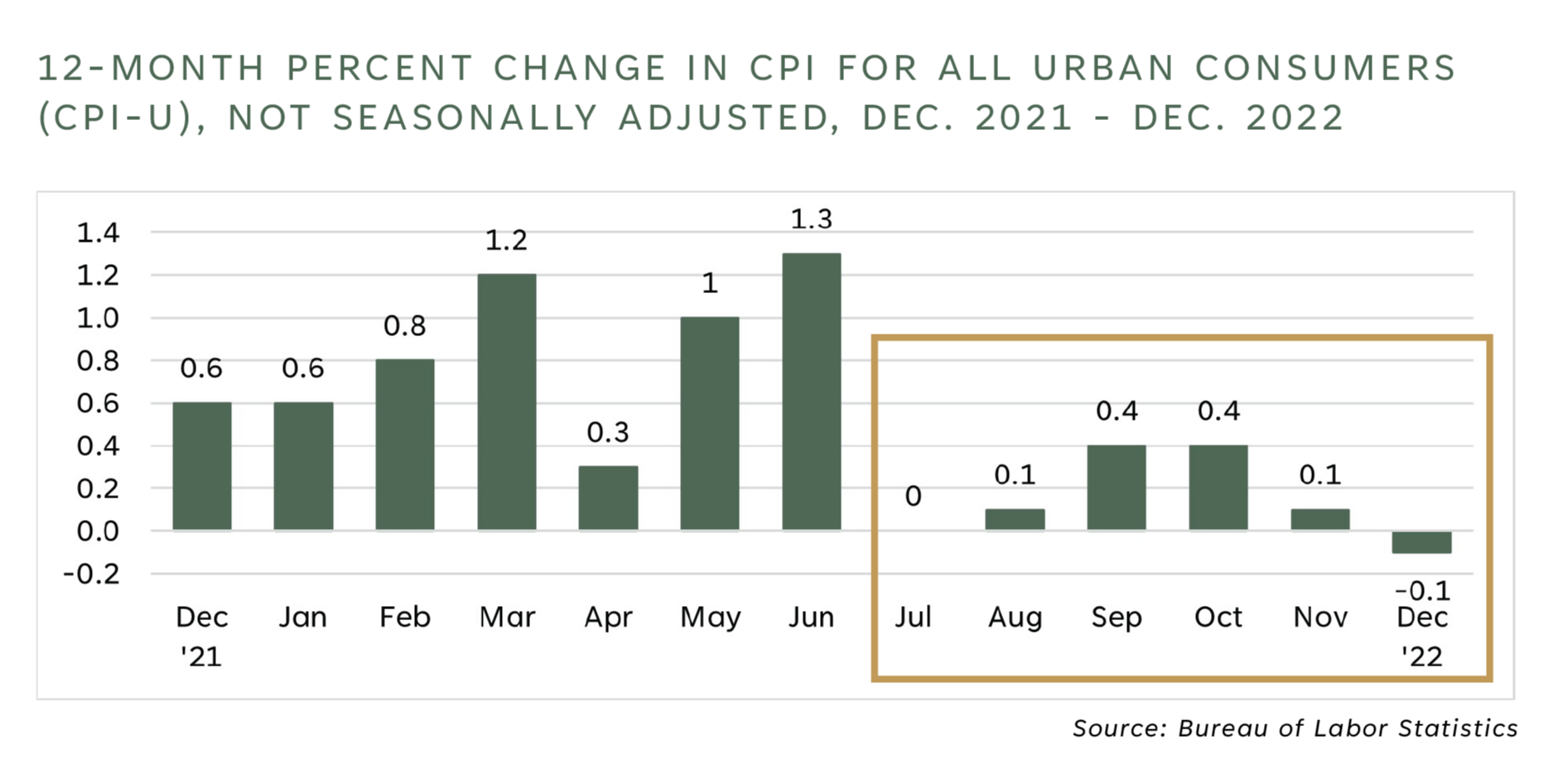

The mainstream view on Wall Street is for the Federal Reserve to cut interest rates by year-end and that the U.S. economy will likely enter a brief recession during the first half of the year. This seems reasonable given recent data. The Consumer Price Index (CPI) showed inflation under 2% on an annualized basis for the last six months of 2022, and wholesale prices as measured by the Producer Price Index (PPI) just showed a decline of 0.5% for the month of December alone compared to estimates of a 0.1% decrease.

Inflation seems to be cooling off quickly, although keep in mind that it’s not uncommon for such a deceleration after a quick spike like what we’ve seen. The real question is where inflation settles as we move into the next year and beyond. At this point, market expectations for 5-year, forward-looking inflation are hovering between 2.0-2.5%.

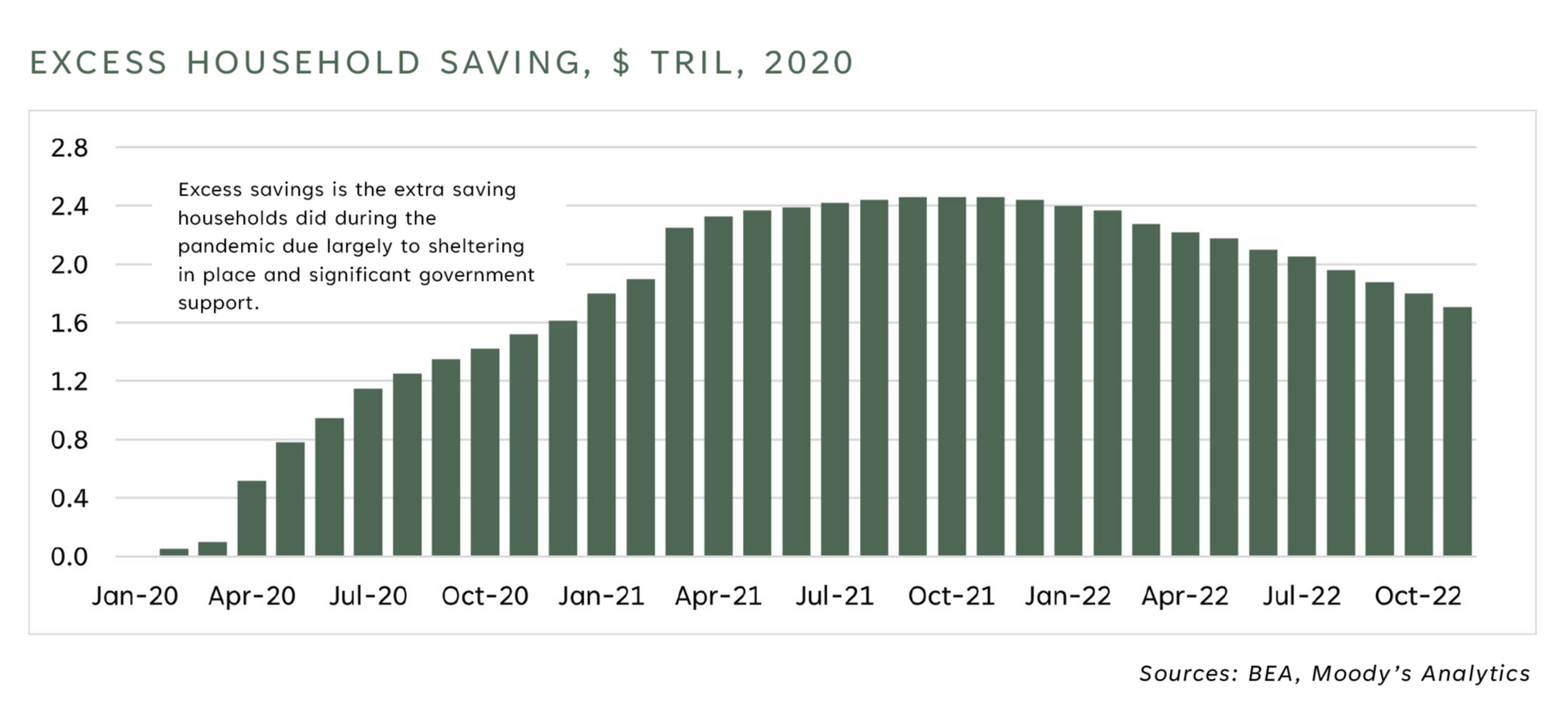

If we enter a recession this year, the usual imbalances are largely nonexistent at this point. There does not appear to be speculative asset bubbles since we’ve already seen assets such as crypto currencies and high-flying growth stocks come down significantly last year. Banks are well-capitalized, businesses have healthy balance sheets, and many consumers still have plenty of excess savings to spend.

Home prices remain elevated despite recent weakness, but a shortage of homes resulting from years of limited construction should help to support home values and soften the blow of a downturn.

Still, the economy has risks as it always does. The Russian/Ukraine conflict could worsen. The Federal Reserve could have a misstep in setting interest rates or managing the runoff of bonds from its balance sheet. China might continue to struggle with Covid-19, or tensions with Taiwan or the U.S. might boil over. Then there’s high government debt levels that the U.S. and other nations have, which become harder to service with higher interest rates.

Even though there are unknowns, and we don’t quite have the investment landscape we had in the early 1980s, there are opportunities for solid returns going forward. We have much more attractive stock and bond markets today than we’ve had in quite some time, which is a great benefit to long-term investors. Despite the potential for continued choppiness in the markets, those who remain committed to a properly diversified portfolio should ultimately be rewarded.

Click below for a printer-friendly version

Charting New Waters: 2023 Investment Landscape

Journey Beyond Wealth (“JBW”) is an Investment Advisor registered with the State(s) of GA, TN, LA. All views, expressions, and opinions included in this communication are subject to change. Registration of an investment advisor does not imply a certain level of skill or training. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy, or the completeness of, any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication's conclusions. Please contact us if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions.

Overview

Location

125 Townpark Drive

Suite 300

Kennesaw, GA 30144

Copyright © 2024, Journey Beyond Wealth is a Registered Investment Advisor. All rights reserved.

Journey Beyond Wealth (“JBW”) is an Investment Advisor registered with the SEC. All views, expressions, and opinions included in this communication are subject to change. Registration of an investment advisor does not imply a certain level of skill or training. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy, or the completeness of, any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication's conclusions. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost. Please contact us if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of JBW, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

Powered by Levitate