Author

Chris McCall

At the beginning of this month, I watched the Disney movie Togo with my family. It’s an incredible story of a Siberian Husky who saves the small Alaskan town of Nome from the onslaught of diphtheria among children in quarantine. Togo leads a team of dogs 261 miles through an epic snowstorm to help deliver diphtheria anti-toxin so the children can be saved. Although Togo is the ripe old age of 12 during this time, his relentless determination carries him through all the trials he and the team endure. What strikes me about this story is how Togo keeps his eyes forward and pursues his goals despite almost falling off a mountain, nearly drowning in the Bering Sea, and several other gut-wrenching, near-death moments where you find yourself cringing and holding your breath.

Investing in the stock market can at times feel a lot like the challenging adventure Togo went through, and the year of 2022 is certainly beginning with a little more excitement than we probably want. Let’s first start with a review of last year when the days were calmer, and we were breathing a bit easier.

A Review of 2021

The S&P 500 index, a prominent benchmark of larger US companies, finished 2021 up nearly 29%. This caps off a 3-year period of a 100% cumulative gain. Yes, the S&P 500 index doubled over the prior 3 years, which is the best 3-year stretch for the index since 1999. The strong performance came in a year that included a $1.9 trillion stimulus package signed in March of last year, a reopening of the economy, global supply chain challenges, labor shortages, and high inflation. Thankfully, corporate profits were surprisingly strong as well.

On the surface, it looks like 2021 was a great year. Digging a little deeper reveals that not all parts of the market performed quite as well as the S&P 500 index. The Russell 2000 index, a benchmark of smaller US companies, gained 15%. In fact, the Russell 2000 Growth index was only up 3%. The MSCI EAFE index, a benchmark of companies in developed countries abroad, was up 11% while the MSCI Emerging Markets index, a benchmark of companies in emerging countries abroad, was down 2.5%. Also, the Bloomberg US Aggregate Bond index, a broad US bond benchmark, was down 1.5%. Big technology companies were a large driver of the S&P 500 index’s stellar gain as 5 of the largest companies finished with incredible performance (Apple +34%, Microsoft +52%, Alphabet/Google +65%, Tesla +50%, and Nvidia +125%).

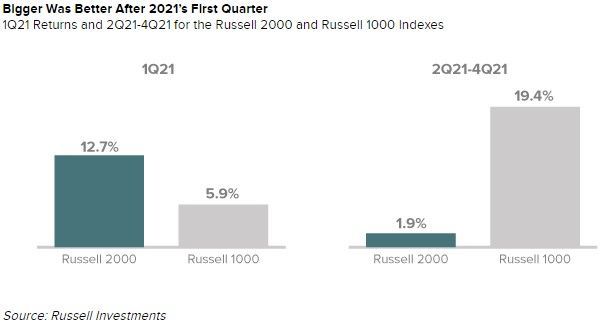

Something interesting started happening throughout 2021 that’s worth noting. The first quarter was a broad rally with smaller companies leading the way. After the first quarter, smaller companies began to lag significantly. The Russell 1000 index is a benchmark like the S&P 500 index except it’s the largest 1,000 US companies rather than the 500 of the largest US companies. When comparing it to the Russell 2000 index for the last 3 quarters of the year, large companies outperformed smaller companies with a gain of 19% versus 2%.

With all the concerns that arose last year between the pandemic, supply chain challenges, labor shortages, and inflation, larger companies can be a safer haven since they’re usually able to better weather the storms over time. More specifically, large technology companies can be attractive when such challenges arise and economic growth is questioned because they have strong balance sheets, high profit margins, and persistent growth. Not only did smaller US companies languish for the remainder of the year, but most of the other indexes also underperformed as did crypto currencies such as Bitcoin (down 21% from the second quarter through the end of the year). While markets looked very strong in 2021 on the surface, they looked a little less impressive when you dig below the surface.

The Markets So Far in 2022

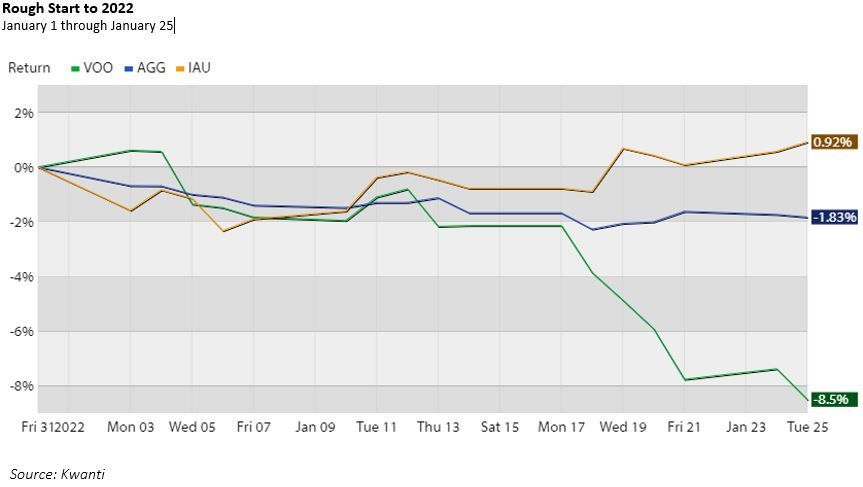

Stocks are starting to lose their footing this year as interest rates rise and markets worry about the Federal Reserve potentially having to play catch-up in their effort to tame inflation. Below, we show 3 investable funds to give a sense for how the markets are doing so far this month through January 25th. Large US stocks as measured by Vanguard’s S&P 500 Index Fund (VOO) are down 8.5%, bonds as measured by the iShares US Aggregate Bond Index Fund (AGG) are down less than 2%, and gold as measured by the iShares Gold Trust (IAU) is up nearly 1%. Interest rates rising at the beginning of this month hurt bond prices initially, although bond prices stabilized when stocks really started dropping in the middle of the month. Gold, typically a safe haven during declines and periods of uncertainty, has provided investors a refuge as volatility picks up. If we drilled down even further, you would see that technology and other high valued stocks have fallen the most.

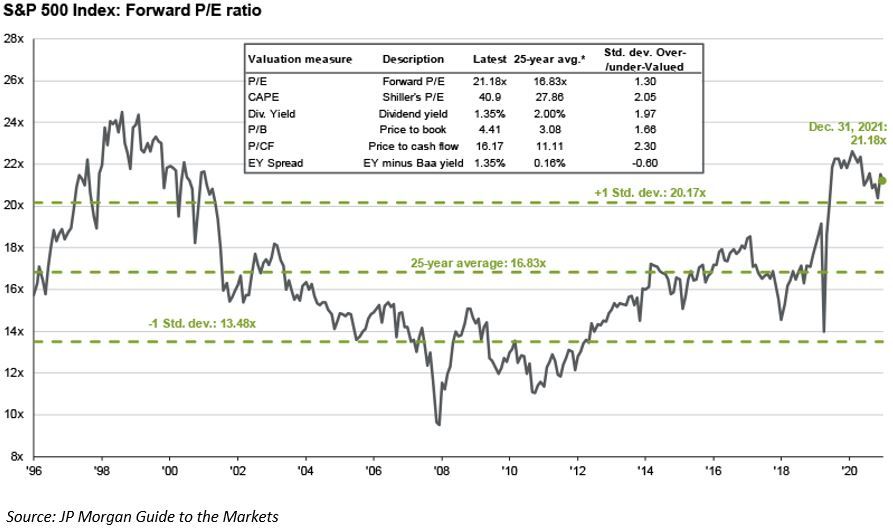

When a bull market has lasted as long as this one has, it needs a breather so it can digest the gains and set up for a new bull market. Part of the reason bull markets don’t last forever is gains usually outpace profit growth. Consequently, valuations become abnormally high leaving little-to-no room for the expansion in valuation to continue. At that point, stock returns become more dependent on the ability of companies to grow profits and distribute dividends.

Through the end of last year, the S&P 500 index had gained over 800% since March 9th of 2009 (the bottom during the Great Financial Crisis of 2007-2008), which is an average annual return of nearly 19%. You can see in the graph below how valuations have doubled over the last nearly 13 years and how high they are relative to the last 25 years.

Markets don’t go down because they’re expensive. Nonetheless, consider Togo and his team of dogs climbing a mountain during a snowstorm. If they were to lose their footing and fall, it would obviously hurt more the higher up they are. As the market climbs the mountain of valuation, there’s potentially more room to fall if it loses its footing.

As we look at the conditions we have before us this year, some of the factors to consider are:

- The Federal Reserve is expected to raise interest rates this year while reducing the size of its balance sheet.

- Tensions are rising between Russia and Ukraine, China and Taiwan, and North Korea and South Korea.

- Corporate profit growth is expected to slow from over 45% last year to 8% this year.1

- Supply chain challenges and labor shortages are still impacting inflation.

- Mid-term elections will be held on November 8th.

What to Do

No one knows how any of the factors mentioned above will materialize this year. Furthermore, it’s impossible to know how they’ll affect the markets since markets always look forward and try to anticipate 6-12 months into the future. This is the part where we offer some words of wisdom for how to navigate the markets this year. Spoiler alert…we’re not going to offer any jaw-dropping suggestions. We follow a disciplined and time-tested strategy while focusing more on managing expectations and behavior along the way.

When we see sensational rallies in certain parts of the market, whether it's technology stocks, crypto currencies, or something else, it’s easy to get swept into the euphoria and want to “bet big” on what’s been doing well. This is the time to have a plan and follow it despite the noise out there. If you’re long-term focused, expect bumps and scary downturns along the way. From an investment standpoint, growing your capital to exceed inflation in the long run should be your main concern. Stick to your long-term plan whatever it may be. If your time horizon is shorter, then don’t take more risk than you need to because losses in value should be your main concern.

Togo’s story is nothing short of amazing. He encounters moments of valiantly trotting along with ease as well as frightening moments where you’d wish you could just blink your eyes and be back to safety again. Last year was a year where most of us probably felt good about the progress in the markets. We need to be grateful for that and know that it can’t be that easy every year. We’re going to experience periods like what we’ve seen so far this year, and we should expect more scary moments as we venture forward. The key to success is having a plan and not giving up when things get tough. When you lose your footing or even if you fall, get back up and keep moving forward in pursuit of your goals.

Journey Beyond Wealth is an Investment Advisor registered with the State(s) of GA, TN, LA. All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy, or the completeness of, any description of securities, markets or developments mentioned. Please consult legal or tax professionals for specific information regarding your individual situation.